Defining Williams %R indicator

Intraday trading is a popular trading strategy among traders. Since the number of day traders continues to rise as time progresses, many technical trading instruments were developed for intraday trading. One of these technical tools is called Williams%R (Williams Percent R indicator). Let us turn into becoming oscillator savvy and get to know the best indicator tools that will help us make profitable trading decisions.

The Williams R indicator, named after its designer, Larry R Williams, is specifically designed to help traders determine whether a stock is oversold or overbought. This is identified as this oscillator links or compares the last closing price to the highest and lowest prices in a particular time period. This widely used momentum indicator operates between 0 and 100 to gauge the prices of a stock.

Calculating Williams %R

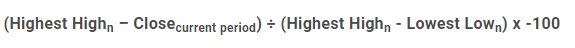

The Percent Range indicator detects overpricing and overselling following the equation below:

Let us parse the elements present in the given equation. The highest high pertains to the highest price recorded within the 14 periods observed. The close value is equivalent to the closing price of the current period. The lowest low value represents the lowest price recorded within the 14-period study.

Here is the step by step process of calculating the %R:

- Identify and note the highest price and the lowest price for each of the 14 periods to cover.

- Record the highest price, the currents price, and the lowest price during the 14th period.

- To compute for the new value of %R, take note of the highest price, current price, and lowest of the last 14 periods (excluding the 15th period).

- At the end of each period, compute for the value of %R by taking in the values within the 14-period frame.

Interpreting the %R Values

Analyzing the Williams R indicator, certain signals will tell the chartists when the stock being looked into is considered either overbought or oversold.

A signal falling within the range of negative twenty up to zero is interpreted as an overbought signal. Meanwhile, a signal pointing within the range of negative eighty to negative one hundred is an indication of an oversold signal. This means that the price is not close to the highest value that occurred in the present range.

Moreover, the Williams R indicator helps traders find opportunities during certain price movements – the uptrend and the downtrend. Particularly, when the intraday trading indicator moves below -80, an uptrend is on the rise. When the indicator moves up to go beyond -80, this means the prices are starting to go high once more.

Limitations of %R

The strategic use of Wiliams R day trading also has its limitations. Contrary to what the indicator tool claims, the occurrence of overbought or oversold signals is not always an indication of a price reversal in the making. One thing that chartists have to keep in mind is that overbought signals send waves for an uptrend.

Another setback of over-dependence on this intraday trading tool is that the Williams R indicator has the tendency to become over-reactive to price changes that lead to false signals. This is particularly true when it yields an oversold indicator, and it begins to move up, and so while the price remains below since the indicator is hardwired to cover the last 14 periods and could not project accurate signals for the succeeding periods beyond the 14th.

Hence, the Williams R indicator is typically no different from the rest of the technical tools for intraday trading in the sense that it should always be used together with all the other indicator tools to be fed with more accurate and livelier trading signals.

Read more: