Understanding Moving Average Indicators

Intraday trading requires reliable technical indicator tools to help traders make lightning-fast trade bets that result in profitable trading. Moving average indicator tools are among the first technical tools in trading designed to aid traders to enter the trading market at the most opportune time.

A moving average indicator tool was instrumental in helping the intraday trading system be more scientific and improve the trading experience of intraday traders. These were the premier models that served as founding tools of the best indicators we have today.

A moving average indicator is the one responsible for adjusting the price that will be seen when a single line is formed by averaging price fluctuations used for intraday trading. The averaging is done by collating the previous prices, which makes the moving average indicator as a delayed indicator. The moving average indicator is used primarily to form systematic ways to follow price trends and, sometimes, to identify support and resistance levels.

Identifying Moving Average Indicator Types

Here are some of the moving average tools used in intraday trading.

Simple Moving Average

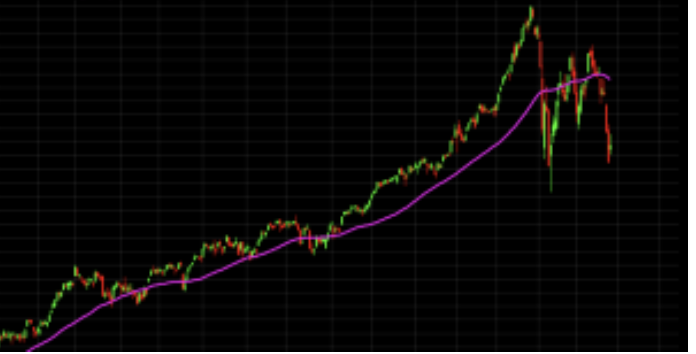

This moving average indicator type is also known as the arithmetical moving average. In essence, this technical indicator works by adding all the prices in a duration of single period occurrences. The sum of these prices is then divided into the number of single periods that occurred.

This indicator tool is commonly used among day traders to plot 50-period price actions and trade in and out of positions since they quickly respond to price actions. EMAs are also more beneficial to utilize when the markets are highly volatile.

(The pink line is the single line formed by connecting the series of points which determines the basic average price.)

Exponential Moving Average

This prominent intraday trading tool yield signals by summing up the definite portion of the present closing price and the moving average value. In this particular moving average tool type, the newest close prices are more significant and valuable.

Another intraday moving average tool-type goes by the name 5-18-13 moving averages. This is a classic indicator tool as it features Fibonacci settings. This tool helps traders in identifying unfruitful and risky intraday trends.

Analyzing the functions of Moving Average indicators

Some traders misconstrue the moving average tools as indicators of future price actions. Since moving average indicators are lagging in nature, they shouldn’t be used to determine future price movement. Instead, they just keep traders on track of the history of the price movements.

Particularly, traders should not take the current trend line formed by the moving average tool since it reflects the current price action at a later time. So, by the time that the tool forms an upward slope, for instance, the direction of the price action has already changed in the present time.

On the other hand, a moving average tool can be beneficial in determining the direction of a trend, while some traders depend on moving averages to determine key support and resistance levels.

To cap it off, a single intraday moving average indicator tool is always never enough to accurately determine price movements, or for any other functions, a moving average tool can be of use. A combination of several technical indicator tools, for one, is a good practice for traders to use these tools on their advantage.

In combining several technical tools, random mix-matching of indicators is not the best way to utilize them but with careful consideration of how the combination of tools will work to complement and support each other to yield accurate results relative to price movement and other trading essentials.

Also, each moving average indicator type has its own unique function, which defines a trader’s search for the best moving average for day trading tool available in the markets.

Read more:

Intraday Trading – RSI indicator

Intraday Trading – Trading Channels

Intraday Trading – Williams %R Indicator