What to Expect From Pepperstone Review

This review is a result of months of performing trade tests through the broker, Pepperstone. This brief literature also alludes to other reviews available online and client testimonies gathered in several websites.

Pepperstone’s various offerings, namely the regulatory body that authorizes its operations, asset types or instruments that it allows for trading, the types of accounts a client can open, the trading platforms that the firm enlists, and the educational materials available through its site, will be tackled and evaluated in full.

A Brief History of Pepperstone

Located in Melbourne, Australia, Pepperstone was established back in 2010 through the effort of a team of able and seasoned traders. Compelled by poor trading conditions and bad customer support, the team founded the firm with one aim in mind: to make leaps in online trading.

In line with this aim, Pepperstone had worked with industry experts to come up with trading technology and had taken itself to offer low-cost spreads to make trading life easier.

To date, Pepperstone has a total of 73,000 clients globally and processes an average of US$12.55 billion worth of trades daily.

Regulation

Being an Australian legal entity, Pepperstone Group LTD. is being regulated by the Australian Securities and Investments Commission (ASIC) with the ABN number 12 147 055 703. Pepperstone got its license on October 27th 2010.

Trading Instruments

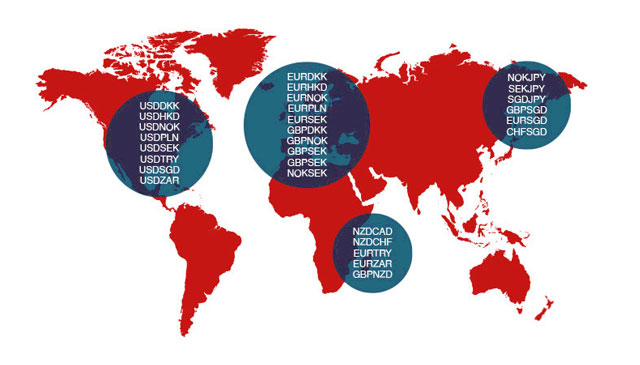

Pepperstone focuses mainly on Foreign Exchange trading. The firm trades 61 currency pairs. Its clients agree that diversifying portfolios through even exclusive Forex trading is possible.

The firm also allows access to 15 soft and hard commodity CFDs. Despite this, a number of users still note that a more extensive selection of CFDs would be commendable. The same could be said of the precious metals that Pepperstone has, being limited only to gold, silver, platinum, and palladium.

Pepperstone gives its clients Index CFDs at an entry level. In addition, 64 Equity CFDs are being offered. However, the critique stays the same, this time, with the more seasoned traders thinking that this selection is still inadequate. With cryptocurrencies, only the 5 are being offered, specifically: Bitcoin, Bitcoin Cash, Ethereum, Dash, and Litecoin

Types of Accounts Offered

Despite saying that a lot is to be desired, especially if we are to focus alone in the selection of trading instruments, clients have actually found Pepperstone’s two types of account offerings to be sufficient.

The first one is the Standard Account. Clients were pleased to note that opening this type of account does not require a minimum deposit. This type of account comes commission-free and with more prominent spreads.

The second account is called the Razor Account. Much like the first acccount, no minimum deposit is required to open one. The Razor Account has an available leverage of 500 to 1 within its branch in Australia, while 30 to 1 in the United Kingdom. Clients are thrilled by these figures as they understand that this is hard to come by in the trading industry.

Available Trading Platforms

Pepperstone had partnered with MetaQuotes to provide the trading industry favorite, MT4 and MT5. It also enlists the services of the ECN’s cTrader platform.

Pepperstone recognizes that the MT4 and MT5 platforms are the mainstream choice for the trading industry, alluding to its customisable features, easy navigation, and wide array of trading tools. The firm also allowed for provisions of its Smart Trader Tools for the aforementioned trading platforms.

Through MT4 plugin, Pepperstone also provides Autochartist.

Pepperstone had also invested in the cTrader platform as well as its enhancement, the cTrader Automate. This gives traders the capability of developing customized indicators or automated trading solutions.

Resource Materials

Pepperstone clients are given access to a wide array of educational materials such as in-house analytics, written content, tutorial videos and webinars. The firm’s own research team is led by Chris Weston and research strategist Sean MacLean who provide market news and insight and various trading opportunities. Clients are in agreement that the articles that the partners produce are highly-detailed and bears the tone of professionalism.

Trading authorities such as BK Forex and FX Evolution also provide research materials such as weekly market outlook and webinars.

The competence of Pepperstone’s education segment is furthered by the Forex section that is divided into 7 distinct categories and trading courses that are handled by guest lecturers with expansive trading knowledge across CFD and Forex trading.

The Active Trader Program

Through the Pepperstone’s Razor Account, clients are availed of the Active Trader Program. These are for high-volume traders in which the traders are paid in a daily basis and directly to these accounts. What the program does is reduce trading costs despite competitive pricing across different trading firms in the industry.

Conclusion and Recommendation

Upon the basis of regulation, trading accounts, and trading platforms, it definitely appears that Pepperstone is a reliable Brokerage Firm. These facets make for good trading conditions and open up an expansive terrain for all trading endeavors.

With respect to actual trading instruments, the firm falls short of selection, albeit sufficient for the more novice traders. This is offset by the Active Trader Program that paves the way for lower trading costs for high-volume traders.

While these are relatively decent things to note, it is still recommended that the reader does his or her own research work and not rely on a single online review.