Trend Trading

Retail traders are enticed to go into online trading in light of Trends. And while there is a myriad of trading strategies meant to follow a trend, a fact of the matter is, there are still many areas wherein retail traders have simply no clue as to what they should do.

This write-up will describe 5 Trend Trading Strategies that a trader like you can opt to employ when trading trends. Do well by reading through them.

Firstly, we must make one thing clear regarding Trend trading: it is a speculative, but conservative at that.

The catch with the Trend Trading Strategies that we will be discussing is that they are simple and bear minimal risks. And while the strategies may gel well with all types of traders, please do note that for the sake of discussion, we will be focusing more on the conservative traders.

You Can Never Go Wrong with Trends

While the statement above would prove right, be advised that as a trade, you must first know how to identify the conditions of a Trend. What you must know primarily is that statistics are not necessarily partial to trending conditions in the Forex Market or, for that matter, the Forex Trend Trading Strategies that you would choose to employ.

Depending mainly on the Currency Pair that one would be trading, the market allows 65% of its time in consolidation. What this means is that Cross Pairs spend a great deal of time on ranges. Though true, the matter stands that trends do exist.

Here are some things that you need to note first:

- Trends are stronger within an extensive timeframe.

- Trend Trading has more potential for profit should those above be observed.

- While this is the case, it is a fact that the Trend trader faces more challenges and failures. The trader should always be alert with continuous reversal conditions

- A reversal in this context may be the sign of a prolonged consolidation period.

With these reminders out of the way, let us now focus on the 5 Trend Trading Strategies:

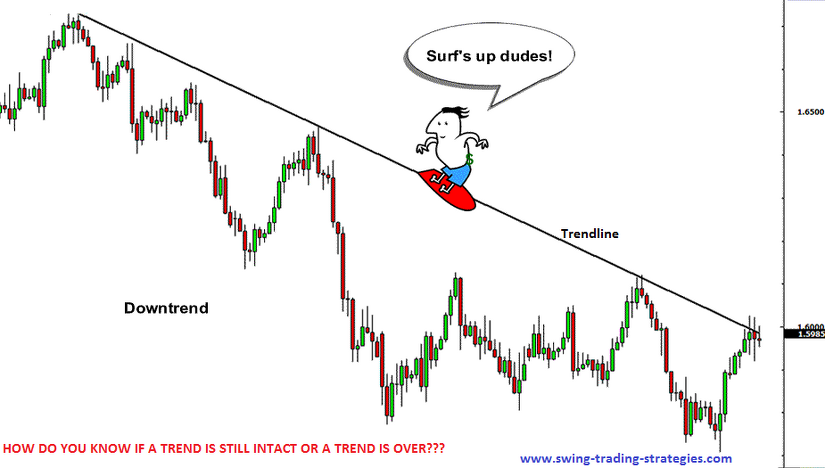

Strategy # 1 – How to Adjust to the Main Trendline

This strategy focuses on achieving perfect Trend Riding. Possibly, the most challenging on the Trend trader’s front, following a trend in the currency market, is tricky because of volatility.

Because of this, the market becomes befuddled, unpredictable, and wholly difficult to make sense of in times of a trend formation.

What has to be noted here for greater understanding is that a trend is composed of Multitude of Lower Lows (LL) and Lower Highs (LH, a Bearish trend) or multiple Higher Highs (HH) and Higher Lows (HL, Bullish trend). A Trendline thus appears when a line is drawn.

Not constant, a proper trendline is always inclined to change and adapt to market conditions in the development of a trend. One must be certain in drawing the Trendline as the trend manifests for the trend to be followed.

In the first stage of Trend development, the absolute high and lower high must be connected. This will be the main trendline, the start of a trend is confirmed as the previous support gave way.

The support then becomes a resistance with the traders dragging the Trendline to the right side. What this is trying to achieve is for the price action not to end while it’s still above the main Trendline.

In the second stage, should the trendline pierces it and does not close above, it is just the right place to sell or go short. Afterward, the main trendline should be adjusted to the new spike.

In the third stage, the process has to be repeated. But a condition has to be met: the price should fail to close above the trendline that had just been adjusted.

Strategy # 2: Follow the Trend Through a Channel

When visualizing a trend, one should use a channel. It is best for such a purpose. However, there are traders who do not have a grasp of the fact that neither perfect channel nor perfect trends are common in the market.

Given its penchant to chaos, the market can break dynamic support and resistance. That doesn’t change channels, however. Channeling, of course, is not the only strategy for following a trend. The main idea here is that the reactions must be made at the edges while a channel forms. Most traders decide on selling the upper edge as he or she buys the lower one in the context of a bearish channel.

To benefit fully from a trend through a channel is to keep an eye out for breakouts.

Financial analyst John Bollinger, a creator of the Bollinger Bands, said that the deviation of prices from trends is normal as the trend evolves. While this takes place, you have to look to the breakout as a sign that you can either go long or short. But one must note apprehensions when trading edges of a perfect channel. This is simply because conditions of a trend are not necessarily partial to perfect channel formations.

Strategy # 3: Moving Averages

Moving averages are efficient technical analysis tools as these show genuine market positions.

2 Moving Averages that are worthy of note:

- MA(200)

Considered the “mother of all Moving Averages.” It is respected and sought-out in the field of Technical Analysis. Once a price inches toward it, all eyes are drawn to it. Should the timeframe be expansive, the MA(200) functions strongly as a support/resistance.

- MA(50)

Like coffee and cream, the MA(50) works well with MA(200). The tandem gives the best signals of changing conditions within the market. Together, they are called Golden Crosses or Death Crosses. These urge traders to respond once movements are seen.

It is desired to see the two averages alongside each other in a chart. Higher timeframes, mean stronger implications.

What is recommendable here is that when the markets test these averages, it will do the trader well to trade them.

Strategy # 4: Using Oscillators

While Trend traders tend to be conservative, some go through lengths to safeguard the trading account. These individuals consciously look for signs that entry is safe, thus protecting the account. Don’t get us wrong, no trade is risk-free, but then placing safeguards and resorting to other measures are more than welcomed.

Enter oscillators. These refer to Technical Analysis indicators changing over a while. It is used to see short-term, overbought, or oversold conditions.

Strategy # 5: Use MACD

When a Trend indicator meets an oscillator, it becomes synonymous with the Moving Average Convergence Divergence, or simply, MACD. This implement is intuitive and functions well with oscillators possessing both positive and negative values. The zero level is its basis.

Employing the MACD means that the price movement shows continuity. It switches from negative to positive or vice versa.

The crossing of the zero level can easily deceive one. While this is happening, the market consolidates wider timeframes. Here a trend is spotted, and the Trendline is already connected to the low. The candlestick corresponds to the crossing as the Trendline is placed on the right side of the chart. These effectively highlight the trend.

Follow the Trend!

So there you have it. The takeaway here is that the strategies for trading trends offer an interested trader efficient options that would have him or her rake in profits with minimal risks. However, these do not always guarantee success. The key still lies in market diligence and proper money management.

Remember, in trading trends, the trader’s penchant is crucial. Reactions of individuals vary for every market situation. What is essential is that one analysis of which strategy would be sound for a given trade. For this, the trader needs to know about each in-depth.