The Counter Trend Move

Defined as the price correction that counters the primary trend, the Counter Trend is smaller in nature. It needs more time to form the entire consolidation pattern.

In this short feature, we will be examining the 5-part procedure effective Counter Trend Trading strategies. These are constituted by both corrective and impulsive moves.

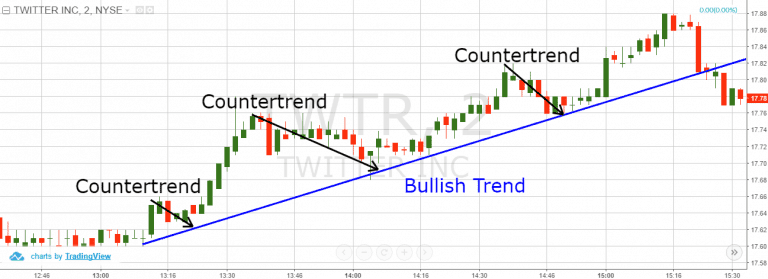

The chart below illustrates a move in the counter trend price:

Here, Twitter’s 2-minute chart from July 11th 2016 shows a blue line that represents the support line of the uptrend. You can also see the 3 Counter Trend price moves that are determined by the black arrows.

Now that you have a mental picture of what Counter Trend Moves in a chart looks like, we can now proceed to the 5 steps to Counter Trend Trading strategies that would have a trader use them successfully. But of course, pertinent to these steps are the rules that need to be followed to establish a lucrative trade.

Step 1: The Opposite Candle Rule

Once an impulse move begins to manifest, it is desirable that a trend line be drawn. Distinguishing between impulses and Counter Trend moves is permitted by this support or resistance line.

Watch out for opposite candles as a stock is trending. This allows for the identification of an impulse move’s impending end.

Before proceeding to Step 2, it is imperative that a candle be identified first. The candle is in contrast to the primary trend.

Step 2: Confirmation

Confirmation can be done in 2 ways:

- Getting another opposite candle.

While this may fail in occasions, (given that 2 opposite candles is a weak signal for confirmation) the rate of success will still exceed 50%. This is enough to materialize a lucrative counter trend tactic.

- Confirming that the candle is a part of a reversal.

A candle may be seen as confirmation of a counter trend. This is what is considered a reversal candle pattern. In the chart, it may manifest as a single hanging man or a shooting star. In the double or triple bottom candle pattern, a reversal candle pattern may also be a double or triple bottom candle pattern.

Step 3: The Contrary Trend

Once an emerging counter trend price move is confirmed, looking into an open position is in order.

Should a Bullish trend be observed, naturally the counter trend will be bearish. This will signal that a short position is desirable to be opened. If the trend be Bearish, then the counter is Bullish.

Step 4: Stop Loss

A stop Loss is always in order when you would want to trade a counter trend. The locations are as follows:

- Bullish – Seen above the high levels. This is just between the trend impulse and the counter trend move that is anticipated

- Bearish – It is below the bottom. However it stands that it is still in between the trend impulse and the anticipated counter trend move.

Step 5: Booking Profits

One should hold the trade until the price action during correction kisses the trend line. Once this is done, one is advised to close his or her trade.

The Right Time to Trade Counter Trend Moves

Simply put, counter trade moves are challenging to trade. This is the case as the trader goes against the primary trend’s direction. False trade signals will result should the trader not be careful.

To weather and avoid potential pitfalls, it would be good to follow the points below:

- Avoid highly-volatile stocks. This is advised as should you be wrong when a counter trend would actually start, you would not fall into the risk of your stop loss for being tripped.

- Within the first hour of trading, steer clear of counter trend moves. This is advised as retail traders are searching for winning or losing positions. In addition, the Technical Analysis is ignored by the price movements. What this means is that it will not go in line with what is predictable that is expected and imperative to counter trend moves.

- Zero-in on trading during midday. Within this period, trading volume is light as Technical Analysis works stronger as compared to periods of high volatility.

The Takeaway

In a nutshell, what you can takeaway from the discussion are the following:

- Impulses and counter trends are created when a price trends.

- “Corrections” is another name for Counter Trend moves.

- Counter Trends are challenging to trade given their smaller price movements. However, these still bear a great potential. Trading a Counter Trend Price is simple should you observe the following steps:

- Determine the Opposite Candle rule within an impulse move

- Confirm either a reversal stick pattern or an opposite candle.

- Trades should be opened opposing the primary trend.

- A stop loss would be placed beyond the spike which is produced in between the impulse and emerging correction.

- Until it reaches the trendline, hold onto the trade.