Markets.com Forex Broker Overview

Servicing for more than a decade, Markets.com caters to both experienced traders opting for low spreads and high-tech platforms and long-term investors looking for a secure and well-equipped broker.

Discover the advantages of trading with Markets.com by reading this forex broker review.

Markets.com Background and Safety

Since its inception in 2008, Markets.com has been providing trading and investments across several financial markets. Markets.com is operated by Safecap Investments Limited which is owned by TradeTech Markets Limited and is a subsidiary of Playtech PLC. Playtech is a firm traded on the London Stock Exchange’s Main Market and is a constituent of the FTSE 250 index.

The broker provides a trading and investment platform for every client backed by good customer service. As a global company, Markets.com operates all around the world and facilitates assistance with its features such as phone support, live chat, Knowledge Centre, and an array of trading tools. Moreover, its customer support is available in many languages including English, French, Spanish, Italian, Arabic, German, and Bulgarian.

Safecap Investments Limited is regulated by the Cyprus Securities Commission (CySEC) and by the Financial Sector Conduct Authority (FSCA). More so, each Markets.com office is regulated by the respective authorities in each jurisdiction. Markets.com offices are in Europe, the U.K., Africa, Australia, and the British Virgin Islands.

Markets.com prides itself in offering a wide range of financial instruments, having more than 2,000 assets across forex, commodities, shares, indices, and cryptocurrencies. The broker also features a Negative Balance Protection to safeguard its clients against losses.

Markets.com Features ad Fees

Market Offerings

Markets.com offers its clients a wide range of financial products in several asset classes including currency pairs (67), shares (2011), index (43), bonds (4), blends (21), commodities (26), ETFs (59), and cryptocurrencies (67). All these are tradable via CFDs.

Account Types

Markets.com features different sets of account types in each of its servicing jurisdiction. Its Europe division offers Classic, Premium, Professional, and GSL. The U.K. entity offers Classic, Premium, and Professional. Africa, Australia, and BVI sites offer the Classic and Premium accounts.

Markets.com traders are classified based on their trading portfolios. To become a professional trader with Markets.com, the size of the trader’s financial instrument portfolio should be over 500,000 euros along with other considerations relative to the client’s trading experience and activity.

Professional traders get to have a maximum leverage of 300:1 in major currency pairs, 200:1 in major indices, 200:1 in Gold trading, 150:1 in commodities, 10:1 in equities, and 10:1 in crypto trading. Moreover, traders using the Professional account are entitled to more trading conditions including requests for a lower spread profile, a personal account manager, access to all Markets.com tools such as analysis and reports, and requests for additional instruments to be integrated into the trading platform.

Funding Methods

Markets.com provides popular means of funding trading accounts. Some of its payment options include Mastercard, Visa, PayPal, Fast Bank Transfer, Skrill, and Neteller.

Negative Balance Protection

This feature protects the trader from further losses as it adjusts the account balance to zero should it become negative after a stop out. In essence, traders do not lose more than their initial deposits.

Overnight Funding

Daily overnight rollover charges may be in effect to every open position at the closing of the trading day at Markets.com. The method of calculation and the amount of charge varies depending on the asset class and current interbank interest rates.

Markets.com Trading Platforms & Tools

Markets.com offers several trading platforms to its clients. It has the MetaTrader platforms in MT4 and MT5 and its proprietary platform in MarketsX.

MT4

Markets.com’s MT4 includes Expert Advisors, micro-lots, hedging, and one-click trading. It also enables instant order execution with low costs based on the broker’s pricing and infrastructure. It is also powered by fully customizable charts and a range of technical indicators.

MT5

This platform supports multiple-asset trading with a complete set of technical indicators. It also has improved trade management using hedging tools. It operates with algorithmic trading with Expert Advisors and it also employs fully customizable multi-time timeframe charts.

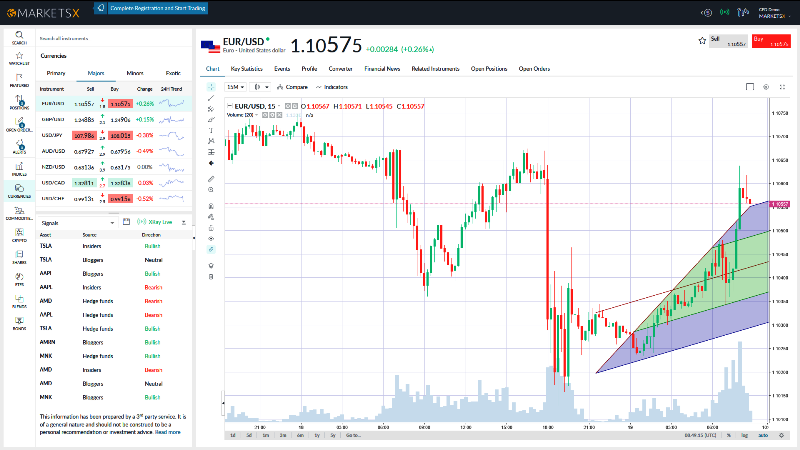

Marketsx

This is a multi-asset platform that houses some of the lowest spreads in the industry. It is also armed with an array of powerful risk-management tools. Marketsx is sporting a range of sentiment, fundamental, and technical tools. Expert analysis is also part of the regular feeds under this platform.

Bottom Line

With its trading platform offerings, Markets.com strikes a good balance between simplicity and functionality. Its research infrastructure is also commendable and provides good trading experience to traders.

What the broker needs to consider is its spreads offering which remains relatively more expensive than other market leaders.