Is SpreadEx a Brokerage We Can Truly Trust?

This review is a result of months spent with the brokerage firm, SpreadEx. The review team had performed an exhaustive examination of all of SpreadEx’s offers and services which can be found directly through its proprietary platform and website.

In its aim of rendering a pointed and well-informed assessment of the firm’s capabilities, the review team opted to look at the following facets:

1. The firm’s regulatory status

2. The trading instruments that the firm gives access to

3. trading accounts that are available through the firm

4. The trading platforms that come with the trading accounts

About Spreadex

Spreadex is a company based in the United Kingdom that specializes in the offering of three betting classifications:

1. Financial Spread Betting

2. Sports Spread Betting

3. Sports Fixed-Odds Betting

Spreadex started its business back in 1999 in Dunstable, Bedfordshire. Former City Dealer Jonathan Hufford founded the company with the goal of making bringing spread betting to the greater public. Nine years into the business, the company moved to St. Albans in Hertfordshire.

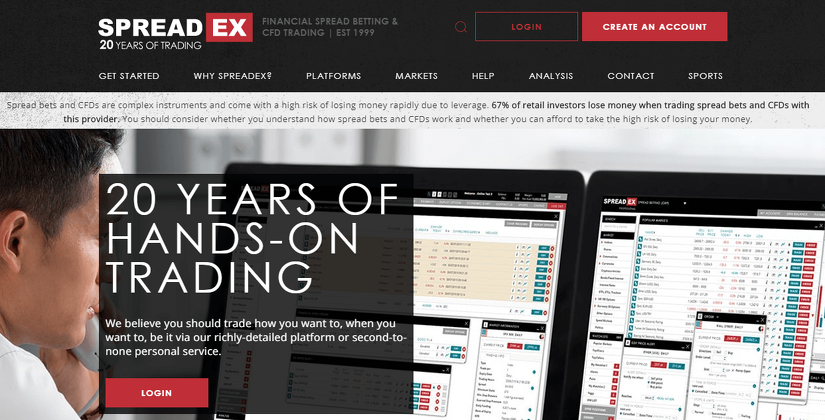

To keep up with the times, Spreadex started offering online sports betting services in 2006. Soon after, the company established its own online trading platform.

Four years further, Spreadex started offering sports betting services thus permitting bets to be executed in both fractional and decimal format.

SpreadEx follows the strict rules and regulations imposed by the Financial Conduct Authority (FCA) as it operates within the United Kingdom.

Offers and Services

Accessible Markets

The trading instruments that SpreadEx allows to trade amount to 15,000 including 51 Foreign Currency Exchange Pairs. Among the other markets that can be accessed through the firm are the Commodity CFDs specifically, Metals, Energies, and Agricultural and the Index and Stock CFDs markets UK Shares, US Shares, German Shares, and Japanese Shares.

One of the things that the review team had noted about SpreadEx’s offers is that with the number of Stocks, it gives access to the highest number compared to major industry players.

Available Trading Accounts

SpreadEx only offers two types of account:

Demo Account

As the name suggests, this type of account is used by traders who would just want to experience how it’s like to trade with SpreadEx without having to put out actual money.

This account is furnished with digital funds that a user can use in simulated trades.

Standard Account

Opening a Standard Account only requires a minimum deposit of at least $1, an amount seen by the review as undeniably cheap compared to its contemporaries. Through this amount alone, a trader may be able to access all the trading instruments that the firm gives access to.

The selection of only two accounts might appear to be too limiting. However, with the minimum deposit only requiring a dollar as a starting amount, the limit could be seen as both accommodating and permissive of more concentrated trades.

However, the review team recommends the addition of more specialized trading platforms given that SpreadEx allows for specific types of sports betting.

Opening an Account

Basic compliance checks are set in place to ensure that the interested parties would not be able to compromise not only SpreadEx’s system, but also themselves.

The following steps and requirements are asked from parties wanting to open an account with SpreadEx:

1. A scanned colored copy of the applicant’s passport, driving license, or national ID

2. A utility bill or bank statement dating back the past three months that that details the applicant’s personal address

3. Answer a number of compliance questions regarding the applicant’s trading experience.

Offered Trading Platforms

SpreadEx offers its own custom trading platform that may be downloaded directly as a mobile application or accessed through WebTrader. For the SpreadEx application, it may be downloaded for both Android and iOS. It is completely customizable, fast, and comes with an intuitive user interface.

Trade with Spreadex Today!

Trading with SpreadEx, while leaving a lot to be desired specifically with the trading accounts that it avails its clients, is decent and has the potential of making huge profits. The following is true regarding SpreadEx’s services:

1. It is being regulated by a trusted financial authority

2. The firm has a wide array of trading instruments that traders can choose from

The review team recommends that the firm steps up in providing more attractive offers. Given that it had been in the industry for the past 21 years, it can definitely rise to the occasion.