IronFX Forex Broker Overview

IronFX provides you with a trading environment that allows you to trade Forex CFDs with competitive spreads and robust backing from its in-house team of industry experts. Its market offering spans over 300 tradable instruments from 6 asset classes available on one single platform. Salient trading conditions of IronFX include milliseconds trade execution, flexible trading leverage, and the lowest market spreads.

Learn the specifics and other important features of IronFX by reading this detailed broker review.

IronFX Background & Safety

IronFX is a trading brand owned by Notesco Limited, an entity that is registered in Bermuda. IronFX was established in 2010 with an aim to deliver the best trading conditions for both retail and institutional traders. Through the years, IronFX has gained a reputation as one of the most recognized and trusted online trading brokers in the world, catering to 1.2 million retail clients globally, from over 180 countries and providing 24/5 support in over 30 different languages.

More importantly, IronFX is a transparent broker that is committed to safeguarding its clients’ investment and ensures that all parties enjoy a mutually beneficial relationship based on trust. Having won over 40 prestigious international investing awards, IronFX gives a strong testament to its winning and innovative trading environment.

The broker is regulated in several jurisdictions including the European Union through Cyprus Securities and Exchange Commission (CySec), Financial Conduct Authority (FCA) in the U.K., and Australian Securities and Investments Commission (ASIC). Traders in the U.K. have broker default protection up to GBP 50,000 through the Financial Services Compensation Scheme (FSCS) while traders from the European bloc get protection up to EUR 20,000 through Cyprus’ Investor Compensation Fund (ICF). They also provide excess insurance for UK clients, lifting coverage to GBP 1,000,000.

Avoiding the potential for misuse, client funds are segregated from company funds. IronFX also operates a counterparty dealing desk, raising conflict of interest issues, but provides direct interbank trading access in some account types. Though the broker has no guaranteed stop-losses, it has negative balance protection in compliance with the ESMA rules.

Unfortunately, IronFX does not offer its services to residents of certain jurisdictions such as USA, Cuba, Sudan, Syria, and North Korea.

IronFX Features & Fees

Market Coverage

IronFX provides access to several asset classes including forex, metals, indices, commodities, futures, and shares. Directly on the MetaTrader platform, users can also trade cryptocurrencies.

Account Types

To meet your needs and style of trading, IronFX offers an array of trading accounts: Standard, Premium, VIP, and Zero Fixed.

Standard, Premium, and VIP are the no-commission accounts. Zero fixed has a commission fee of $18/lot on the EUR/USD pair. Also, the three account types have flexible leverage up to 1:1000. The maximum leverage for the Zero Fixed account is higher at 1:1500.

The required initial deposit varies from one account to another. Standard requires a $100 initial deposit. Premium starts at $1,000 while VIP asks for a $10,000 minimum deposit. Zero fixed requires a $500 deposit.

In terms of spreads, Standard starts with 1.8 pips, Premium with 1.6 pips, and VIP with 1.4 pips. Zero fixed has no spreads. All the account types have access to the Dealing Department Transaction Hotline and a dedicated account manager.

IronFX charges a $50 fee after one year of account inactivity. Demo accounts are also available for traders who want to conduct a dry run of their trading moves.

Funding Methods

IronFX traders are given several options for deposits. Some of these include bank wire transfer, credit/debit card, Skrill, Neteller, FasaPay, China Union, and DotPay.

On the contrary, the broker has a limited withdrawal option as profits can only be withdrawn via bank wire transfer. Lead time for withdrawal requests varies depending on the banking provider but ranges from one day to seven days.

Promotions and Bonuses

IronFX gifts a welcome bonus to new account users ranging from 20%-100% depending on the deposit amount. These bonuses, however, cannot be withdrawn. They can only be added to your trading capital and offers vary in different countries.

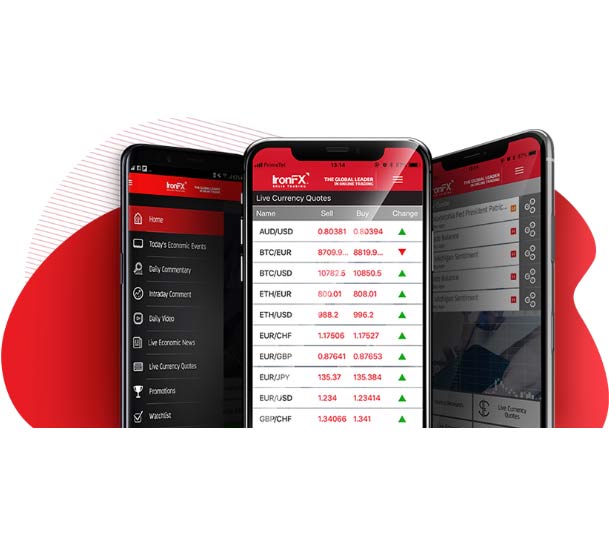

IronFX Trading Platforms & Tools

IronFX offers Metatrader 4 to traders available in desktop version, web version, and mobile app version.

MT4 is armed with advanced charts with nine timeframes. It also has over 30 built-in technical indicators, real-time news, and automated trading capabilities. MetaTrader’s Market and Signals, where users can buy technical indicators, can be integrated in the platform to provide additional functions, including signals for copy trading.

IronFX also offers a Personal Multi-Account Manager (PMAM) system, which lets traders manage multiple MT4 accounts at the same time.

IronFX Academy is the broker’s educational center that features several learning resources for novice traders. Educational videos along with an encyclopedia and five e-books round out a broad curriculum, with skill trading across a variety of topics that include market analysis, trading psychology, strategies, signals, CFDs, and technical indicators.

Bottom Line

IronFX is a good try for starting traders as the broker provides competitive pricing, account type options, and a good range of financial instruments. Despite parading the industry popular MT4, the lack of trading platform option is a concern for skilled traders looking for more advanced trading solutions.