FP Markets: A Year-End Review (2020)

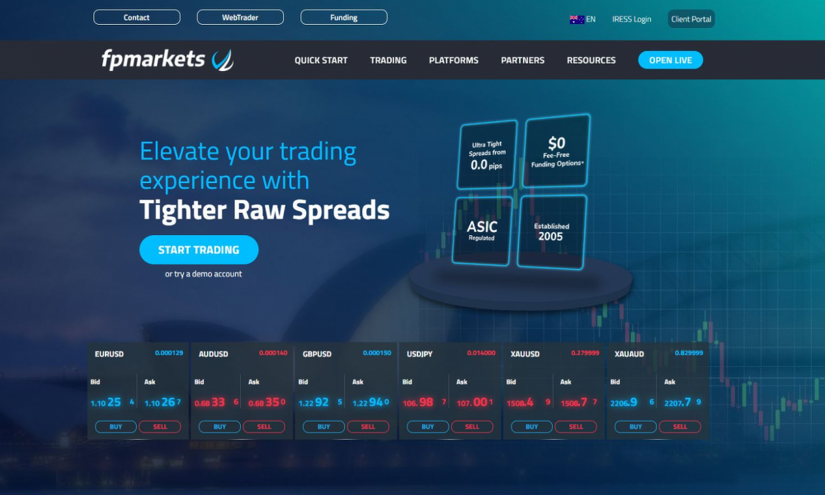

Founded back in 2005, FP Markets is brokerage firm based in Australia that had gained a positive reputation within the trading industry. Preliminary data shows that this is owed to two things:

- FP Markets’ regulation through the Australian Securities and Investments Commission (ASIC)

- The firm being a recipient of the CySEC license

The second premise is held beneficial to clients as it fosters legal trading environments through the guidelines implemented by the ESMA and the MiFID. What these declarations tell its traders is that the firm gives great importance to fair and legal treatment of its clients given its stringent adherence to international laws and requisites.

One more thing that had caught the attention of the review team and undoubtedly the online trading community is FP Markets’ offering of highly competitive spreads.

Should the review team base its decision through these premises alone, it would already prove to be a wise move. As this is the case, this review is only being lodged in light of the aim of wanting to quantify the premises for FP Markets’ positive repute further.

Methodology

The review team conducted an exhaustive examination of all the offers and services of FP Markets so as to render a pointed and informed assessment. This methodology had entailed the actual usage of the features and functions that can be found on the platforms and trading accounts that are being offered by FP Markets.

The review team had also looked into the reviews that had already been published through the worldwide web. The team had conducted organic searches online so as to see what the other reviewing bodies are saying about the firm. While these have been taken into large consideration, the matter stands that the review team’s assessment is not entirely influenced by these reviews. These had only been gathered so as to see some intersecting points and confirm certain contentions.

This review focuses on the following facets of FP Markets’ service:

- The trading accounts available to the firm’s clients

- The offered trading platforms

- The fee structure that the firm had created

- The spreads that the firm provides

- The other tools available through the firm’s platforms and accounts

Trading Accounts

The fees and deposits that traders are charged are of course reliant on the type of the trading account the trader chooses to open.

The Forex accounts that are being offered through the firm are categorized in three:

- The Standard Account

Only 100 AUD is required to open this type of account. The spreads available through this account start from 1.0 pips. The trading instruments available through the firm include over 50 forex currency pairs, metals, indices, and commodities. The maximum leverage is 500:1 while the minimum trade size is at 0.01 Lot.

The Standard Account offers the MetaTrader 4 and MetaTrader 5.

- The Raw Account

Like the Standard Account, the Raw Account is also opened with 100 AUD. The spreads available through this account start from 0.0 pips. Its trading instruments are the same with what the Standard Account offers. The only major difference that this account has from the Standard Account is the commission that is implemented for each lot. The commissions for the Raw Account are priced at $3 with every 100,000 lot.

The platforms MT4 and MT5 are also being offered through the Raw Account.

- Islamic Accounts

FP Markets also offers Islamic Trading Accounts. Also known as Swap Free accounts, Islamic Accounts that adhere to Sharia Law. As the Islam faith sees trading as “haram” or forbidden, the Muslim members of the trading community are only allowed to trade if the account is under customized settings takes cues from the Sharia Law. This adherence prohibits traders from making payments or receipt of swaps or rollover interests via overnight positions.

Through this, FP Markets expands its market reach through the provision of such, even including members of the Islamic faith.

The Islamic Accounts offers the MT4 and MT5 platforms.

These accounts are seen as highly efficient and offer up many trading opportunities that FP Markets clients can make profitable from. The online testimonies that had been gathered by the review team also affirm the tests done from their end.

The spreads offered within every account are noteworthy and the minimum deposit being low enough for novice traders to avail.

Trading Platforms:

MetaTrader 4 and MetaTrader 5

FP Markets’ offering of MT4 and MT5 is also a welcome measure.

FP Markets recognizes the gratuitous benefits of partnering with MetaQuotes. The partnership allows the firm to provide its two widely-known and well-received platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MetaTrader 4 (MT4)

MetaTrader 4 (MT4) is known for its speedy executions and is wholly admired by the online trading community for its over-all efficiency. MT4’s standout features are usually highlighted in reviews. The review team cites the following features as a basis for its positive image:

- One-click trading

- A number of technical indicators

- A selection of charting tools

- Expert Advisors (EAs) for automated algorithmic trading

- Advanced order types

MetaTrader 5 (MT5)

While not as popular as MT4, MT5 offers a great deal of beneficial features including:

- Wholly flexible lot sizing

- A number of funding and withdrawal options

- Tight spreads

- Market depth

MT4 and 5’s interfaces are easy to navigate. These are also available through a web version and a mobile application.

Fee Structure

As already pointed out earlier, the fees required of clients depend on the type of account and the platform the clients choose to open.

The following table details the fees implemented by FP Markets through its trading accounts:

| Instrument | Standard | Raw |

| Forex | Zero (Built into the spread) | 3.50 (AUD, CAD, SGD), 3 USD, 2.75 EUR, 2.25 GBP, 20 HKD, 250 JPY* |

| Metals | Same as above | 3.50 (AUD, CAD, SGD), 3 USD, 2.75 EUR, 2.25 GBP, 20 HKD, 250 JPY* |

| Commodities | Same as above | Zero (Built into the spread) |

| Indices | Same as above | Same as above |

| Cryptocurrencies | Same as above | Same as above |

Given what it offers, the fees for the Raw Account are reasonable. The Standard Account, while admittedly attractive in light of its low charges, do not necessarily render results desired by traders who had availed of the account. The review team sees the Raw Account to be a commendable option in that it requires the same minimum deposit, but with more beneficial features and offers.

Spreads

The review team had found that the FP Markets to offer highly-diverse liquidity through different banking institutions the brokerage is partnered with. This is already in addition to the tight spreads that start at 0.0 pips.

Other Trading Tools: The Forex Calculator

FP Markets also offers a Forex Calculator that has the specific functions:

- Pip Calculator

- Currency Converter

- Margin Calculator

- Swaps Calculator

- Profit Calculator

The usage of these calculator functions allow for insight into where they are spending their money.

Trade With FP Markets Today!

The review team had found FP Markets to offer advantageous offers to its clients. The firm’s trading accounts feature good functions and offer justifiable fees.

It is also a good measure that FP Markets offers Islamic Accounts for the Muslim trading community; this paints the brokerage firm as a highly inclusive company characterized as client-centric.

In addition to its legitimacy, the review team highly recommends FP Markets for those wanting to enlist the services of a broker.