Does easyMarkets Really Make for Easy Trading?

This review is a result of months spent with easyMarkets. It is the aim of the review team to render a pointed and informed assessment of all the offers and services provided by the firm.

To serve the cause, the review team focused on the following facets of easyMarkets’ services:

- The regulatory body that sanctions all of easyMarkets’ trading activities

- The trading instruments it gives its clients access

- The trading accounts that the firm makes available to its clients

- The trading platforms offered by easyMarkets

- The Spreads and Maximum Leverages available to account holders

About easyMarkets

Established back in 2001, easyMarkets aims at one thing: to democratize trading. The brokerage had declared that it recognized the need to bring trading to the greater population. Upon the inception of the firm, the founders had observed that mostly, it is the richer individuals who are given the opportunity to get make it big and gather handsome profits from trading.

To serve the cause of reaching out to the masses, the firm started requiring only $25 as an initial deposit which can be done through cash, online transfer, or credit card, to spare interested parties from lengthy bank transactions.

easyMarkets goes under regulation through Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC) two leading financial authorities in the industry.

From trading Foreign Exchange currencies, easyMarkets had branched into other asset classifications such as CFDs, Global Indices, Energy, and Metals, among others.

Offers and Services

Accessible Trading Instruments

Making trading accessible to more people through reduced costs, easyMarkets had made it possible for the firm’s clients to access the following markets:

Forex

Foreign Currency Pairs are one of the first instruments traded by easyMarkets in 2001. Through this market, clients are availed of Fixed Spreads, Negative Balance Protection, Free Guaranteed Stop Loss, and a dealCancellation option that comes with a small fee. The Forex pairs that clients are provided with are a mix of major pairs, cross pairs, and a few exotic pairs.

Shares

The Shares that clients are given access to through easyMarkets amount to a total of 17. These include the biggest global companies including Alibaba, Amazon, Apple, Facebook, and Netflix, just to name a few. Clients are guaranteed of no slippage, competitive Fixed Spreads, Free Guaranteed Stop Loss, and Negative Balance protection.

Cryptocurrencies

easyMarkets recognizes that cryptocurrencies are bound to stay in the trading industry. To take advantage of this, easyMarkets gives clients access to the three major digital coins in the crypto industry: Bitcoin, Ethereum, and Ripple.

Metals

Seen as government standard, easyMarkets aims to give metal traders the opportunity to trade just about anywhere with a dealCancellation option. Through the firm the metals, Gold, Silver, Platinum Palladium, and Copper could be traded.

Commodities

The firm allows for the trading of commodities like, Copper, Crude, Natural Gas, and other agricultural products as it knows that trading such is easy and have the capacity of being rendered stable. Clients are also given the dealCancellation option and are permitted to trade anywhere through mobile devices.

CFD Indices

easyMarkets knows why trading CFD Indices is a good option. Having the capability of quoting the price of multiple stocks, indices are able to average out volatility. Through the firm, traders would be able to trade leading indices such as US 500, US 30, US Tech, and Germany 30 just to name a few.

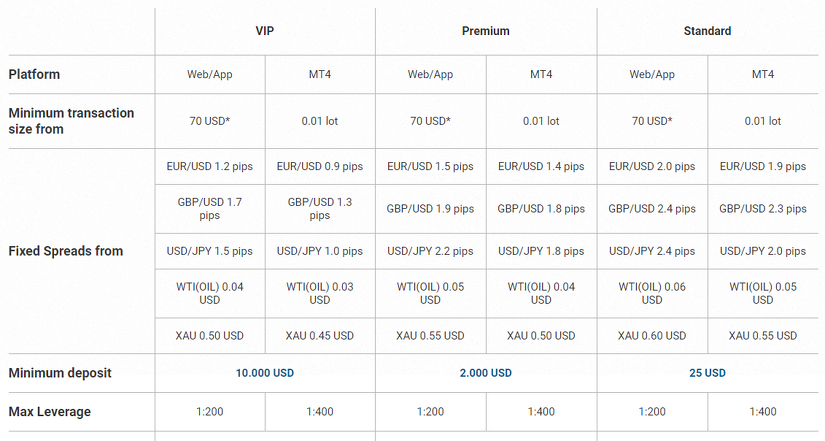

Available Trading Accounts

easyMarkets offers 3 types of trading accounts to its clients. The offers that come with each are detailed through the table below:

Note that all the accounts come with 0 Commissions, no Account Fees, and no Deposit and Withdrawal fees. Each account is also allowed over-the-phone customer support, 24/5 phone and live chat trading, and a Personal Account Manager.

The review team notes that the minimum deposits come for each type of account is justified and allows traders to get their money’s worth.

Offered Trading Platforms

easyMarkets offers three trading platforms:

The easyMarkets Web Platform

Highly-intuitive and therefore easy to use, the easyMarkets Web Platform gives access to good trading conditions through its compatibility across all browsers, its numerous analytical tools, the dealCancellation and Free Guaranteed Stop Loss and Take Profit options, zero slippage, and a mobile application.

The easyMarkest MT4

The firm offers industry favourite, the MetaTrader 4 platform. Through MT4, the traders are provided with Negative Balance Protection¸ Trading Central news and analysis, and complete chart customization.

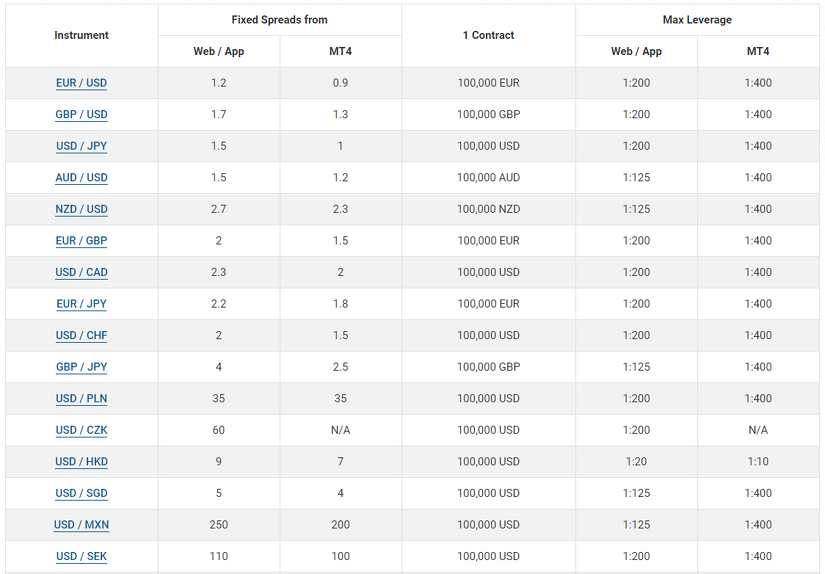

Spreads and Maximum Leverages

easyMarkets offers Fixed Spreads that are impervious to the volatility of the markets. Conditions and contract sizes are accessible to just about anyone, may he or she be a novice or a seasoned trader. The brokerage has small minimum contracts and competitive leverage.

The table below samples the spreads and Maximum Leverage available through easyMarkets:

Easily Trade with easyMarkets Today!

Through the points discussed in this review, it is easy to see why easyMarkets is a viable option to do trades with. The following had been observed by the review team to have contributed to its positive assessment:

- A wide array of trading instruments

- The competitive trading platforms

- Sound minimum deposits across all trading accounts

- Sound offers for each trading account

- Competitive Fixed Spreads and Leverage

Indeed, easyMarkets stands by its aim of democratizing trading through these advantageous offerings. As such, the review team recommends that interested parties have a go at signing up with the brokerage.